Forex Trading for Beginners: A Comprehensive Guide

Forex trading can be an exciting avenue for making money, but it’s also one that can lead to substantial losses if not approached with the right knowledge. For beginners stepping into this vast world of currencies, gaining a solid foundation is crucial. This guide aims to introduce you to the basics of forex trading, covering terminology, strategies, and practical tips to kickstart your trading journey. Don’t forget to check out the forex trading for beginners Best Indonesian Brokers to find a suitable broker for your needs.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying and selling currencies on the global market with the aim of making a profit. The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike other markets, forex trading happens 24 hours a day, five days a week, making it accessible regardless of where you are in the world.

Understanding Currency Pairs

In forex trading, currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency listed in a pair is known as the “base currency,” while the second is the “quote currency.” The price of a currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding how to read currency pairs is fundamental for any forex trader.

Key Terminology

To navigate the world of forex trading, it’s essential to familiarize yourself with some key terms:

- Pip: The smallest price move in a currency pair, typically the fourth decimal place (0.0001).

- Spread: The difference between the buying (ask) price and the selling (bid) price of a currency pair.

- Leverage: The ability to control a larger position with a smaller amount of money, allowing for greater potential profits—and losses.

- Margin: The amount of money required in your trading account to open a leveraged position.

- Lot: A standardized quantity of currency in a trade. In forex, a standard lot is typically 100,000 units of the base currency.

The Importance of a Broker

Choosing the right forex broker is one of the most critical decisions you’ll make as a trader. A broker acts as an intermediary between you and the forex market, and they can vary significantly in terms of fees, trading platforms, and features. It’s vital to select a broker that suits your trading style and needs. Factors to consider include regulation, trading instruments, commissions and spreads, and customer support.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in forex trading. It outlines your approach to the market, including your risk management rules, entry and exit points, and the analysis techniques you’ll use. There are various types of trading strategies, such as:

- Day Trading: Involves opening and closing trades within the same day to capitalize on short-term market movements.

- Swing Trading: Focuses on capturing short to medium-term profits over several days to weeks.

- Scalping: A strategy that involves making multiple trades throughout the day to take advantage of small price changes.

Regardless of which strategy you choose, always be disciplined and adhere to your trading plan.

Risk Management

Effective risk management is crucial to protect your capital and ensure long-term success in forex trading. Here are several techniques to help manage risk:

- Setting Stop-Loss Orders: These orders automatically close your trade at a predetermined price level to limit your potential losses.

- Position Sizing: Determine how much of your trading capital you are willing to risk on each trade. A common rule is to limit risk to no more than 1-2% of your account balance.

- Diversification: Avoid putting all your capital into one currency pair. Spread your investments across different pairs to mitigate risk.

Technical and Fundamental Analysis

Understanding market trends is essential for making informed trading decisions. Traders typically rely on two primary types of analysis: technical and fundamental.

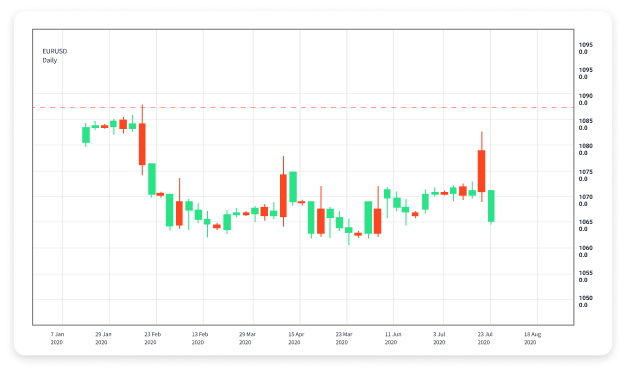

Technical Analysis

This method involves analyzing past price movements and using chart patterns, indicators, and various analytical tools to predict future price movements. Technical analysts look for trends, support and resistance levels, and other market behaviors to create trading signals.

Fundamental Analysis

Fundamental analysis focuses on understanding economic indicators, news events, and geopolitical factors that might influence currency values. These can include interest rates, employment data, political stability, and economic growth reports.

Emotional Discipline and Psychology

The psychological aspect of trading is often overlooked, yet it can significantly impact your trading performance. Successful traders possess emotional discipline, allowing them to stick to their strategies and avoid impulsive decisions based on fear or greed. Consider implementing these techniques to enhance your trading psychology:

- Maintain a trading journal to reflect on your decisions and learn from both successes and mistakes.

- Set realistic goals and avoid overtrading in an attempt to achieve high returns quickly.

- Take breaks when needed, especially after experiencing losses, to clear your mind and regain focus.

Continuous Learning

The forex market is dynamic, and continuous learning is essential. Stay updated with the latest market news, economic reports, and changes in regulations that could influence your trading. Utilize trading simulators to practice and develop your strategy without risking real money, and consider joining trading communities or forums for shared insights.

Conclusion

Forex trading presents a world of opportunities for aspiring traders. While it requires dedication, patience, and knowledge, understanding the fundamentals outlined in this guide can set you on the right path. Remember, every successful trader started as a beginner, so commit to learning and practicing continually. As you become more experienced, you’ll develop your unique trading style and strategies. Good luck on your forex trading journey!